In 2017, it looks as though the sugar market will move back into a surplus position, following two years of deficit production. The sugar market has already reacted strongly. Speculators have removed their record long position in the market, which was reached in October 2016.

Increased crop planting grows supply

The transition to a surplus position is largely driven by increased sugar cane and beet plantings. These have been concentrated in several areas around the world. For example, in Thailand we could see sugar production rebound by up to 18.5% in the coming crop year. This is because the government has been incentivising farmers to plant sugar cane ahead of rice, as it seeks to wind down a disastrous rice stocking programme, which almost bankrupted the country in 2014. We also expect a significant rebound in beet sugar production in the EU in 2017. This is linked to the planned liberalisation of the European sugar market in October 2017, when production quotas are to be abolished and producers will be free to market their sugar as they wish. Beet plantings across the EU are already estimated to be approximately 15% higher year on year.

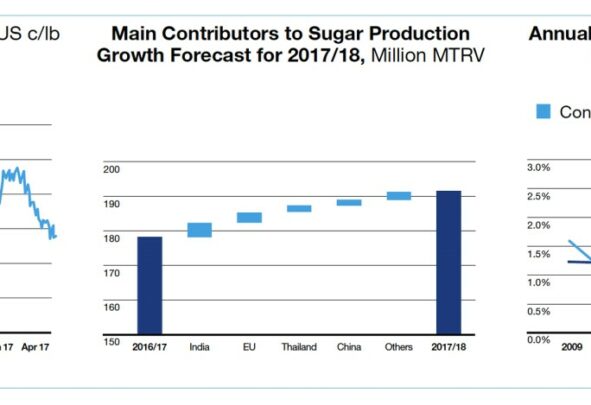

However, there is risk involved. Such an intense concentration of plantings makes our forecasted increase in sugar production for 2017/18 vulnerable to adverse weather. But, all being well, we think global sugar production in the 2017/18 crop year could reach a new record of 192 million metric tonnes raw value

Slower consumption rate also playing its par

There is another factor influencing the surplus sugar position and that is sugar consumption, which has been growing at a slower pace than we have become accustomed to. Global sugar consumption is driven by three factors, population, income and local tastes:

> Virtually everyone on the planet eats sugar as part of their diet and therefore population growth means higher sugar consumption. With the world’s population estimated to be growing at a little over 1% a year, we have a baseline against which we can measure sugar consumption growth

> An increase in income can boost sugar consumption from a very low level. As sugar is a source of cheap and enjoyable food, small changes in income at low wealth levels can lead to a rapid acceleration of sugar consumption

> As economies develop and processed foods become more readily available sugar consumption increases. However, this trend does not continue indefinitely, and consumption eventually plateaus.

The level at which this happens varies by region and according to local tastes and influences. This is why, for example, per capita sugar consumption in Japan is a third of what it is in Brazil, despite Japanese GDP per capita being appreciably higher.

Consumer-led or industry-driven?

In many developed economies, we have observed falling per capita sugar consumption in recent decades. For example, sugar consumption per person in the UK peaked in around 1960 and Australian per capita sugar consumption peaked in the early 1950s. Persistent headlines about the negative health effects of excessive sugar consumption have undoubtedly exacerbated this trend. But only to a certain point. Eating sugar is an enjoyable, and often celebratory, treat – it would be hard to imagine Christmas, Diwali or the breaking of Ramadan fasts without some sweet rewards. Nonetheless, alongside some day-to-day moderated consumer behaviour we are also likely to see decreased sugar consumption as a result of product reformulation instigated by manufacturers, whether by lowering the percentage of sugar in a product, replacing sugar in beverages with alternative sweeteners, or reducing portion sizes

Complex sugars

We have already seen the aggregate impact of these changes on our own estimates of global sugar consumption. In previous years, a 2% growth rate per year was a normal assumption. The exceptions to this rule were 2010 and 2011 when global sugar prices were above 30USc/lb. For 2016, 2017 and 2018 we think the rate of sugar consumption growth will instead be closer to the 1% level of population growth. Put another way, globally, per capita sugar consumption could decline during these years

However, we are not fully convinced that this downward trend is here to stay as there are complex factors in play. Built into these sugar consumption forecasts are several one-off changes. The deregulation of the European sugar market in October 2017 is likely to see increased use of other sweeteners, particularly isoglucose in the East. Meanwhile India removed 85% of its banknotes from circulation at the end of 2016. Operating largely as a cash economy, this move has limited the ability of Indian consumers to purchase, and therefore consume, sugar. We have also seen sugar consumption hit by government interference and war in areas as diverse as Venezuela, Egypt and Syria. Away from these troubles, we still expect sugar consumption to increase in line with population and incomes in sub-Saharan Africa and Southeast Asia, with growth in these regions more than offsetting any declines in Europe and North America and underpinning the sugar market in the medium to long term

What does this mean for Czarnikow?

On aggregate, this means that the volume of traded sugar around the world should remain robust, despite the various and complex local factors at stake. A key advantage for Czarnikow in this era of unprecedented change will be the value of our long-term client relationships. As a Group, we have always been nimble when confronted with changing market trends – whether macro or micro – enabling us to work closely with our clients to understand their immediate needs

Our team of 15 analysts across 11 time zones ensures that we continue to enhance the quality and delivery of our analytical content to clients and provide a technologically sophisticated and unparalleled analysis of the sugar market. Finally, we never underestimate consumer power and its influence, as people become more discriminating in their sugar purchasing and consumption. Czarnikow’s sustainable supply programme, Vive, allows us to promote best practice and to control valuable supplies of sustainably-sourced sugar to meet the discerning needs of modern multinational companies and their consumers.